At Circulate, a Manchester-based SEO agency, we have analysed the women’s fashion search landscape, who’s winning, where the gaps are, and how Rat & Boa can scale organic growth.

Who is Rat & Boa?

Rat & Boa is a UK womenswear brand founded in 2015 by friends and co-creative directors Valentina Muntoni and Stephanie Bennett. Known for bias-cut slips and statement prints that sit between occasion and vacation wear, the label built a cult following via fashion press and social-first styling. Their mood-led aesthetic centres on confidence and individuality, with recent category expansion beyond dresses into swimwear. Quality and longevity sit at the core, lightweight fabrics are carefully chosen, and the brand produces thoughtfully to avoid overproduction.

SEO Snapshot

We analysed Rat & Boa’s top-level SEO performance across traffic, authority and keyword rankings.

Estimated monthly organic traffic

- Traffic jumped a lot in spring 2025, then cooled off over the summer.

- In August, the website was attracting an estimated 50k+ visits per month which is about half of the spring high, but still higher than last autumn.

- Some of this dip is normal for summer, but the website has slipped a little on a few big search terms.

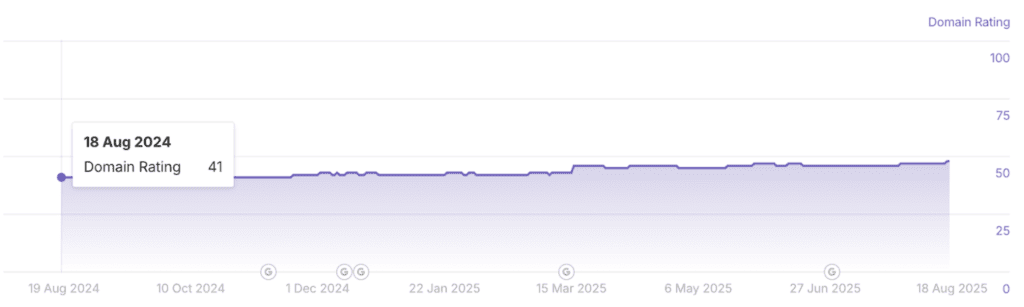

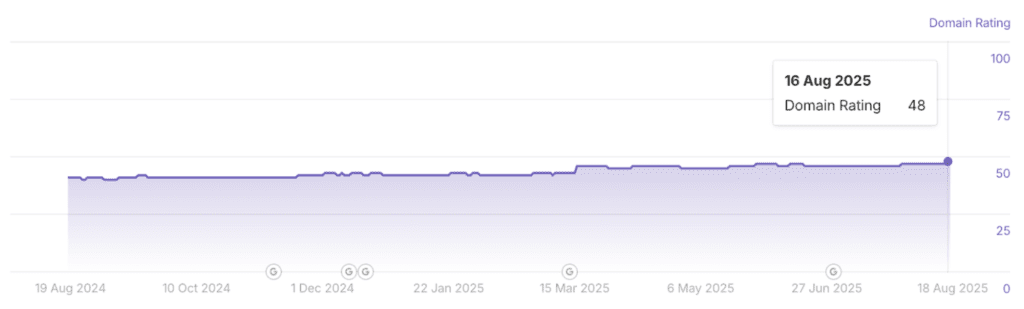

Domain Authority

- DR has risen from 41 to 48 over the last year (+7) which shows consistent progress.

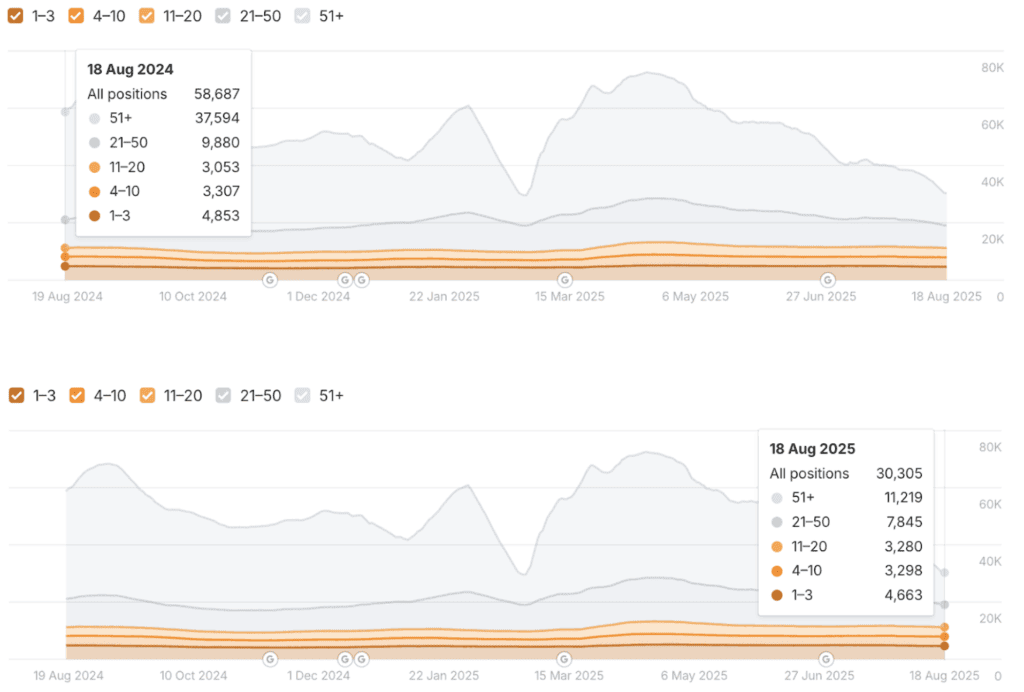

Keyword rankings

- Top ranking spots are fairly steady but have dropped around 4% year on year.

- The biggest change has been keywords that rank lower down the page. The total number of keywords Rat & Boa rank for fell from 58.7k to 30.3k. Most of that drop is in very distant rankings (keywords ranking in position 51+), which went from 37.6k to 11.2k. These bring little traffic anyway, but it does mean we’re showing up for fewer long-tail searches.

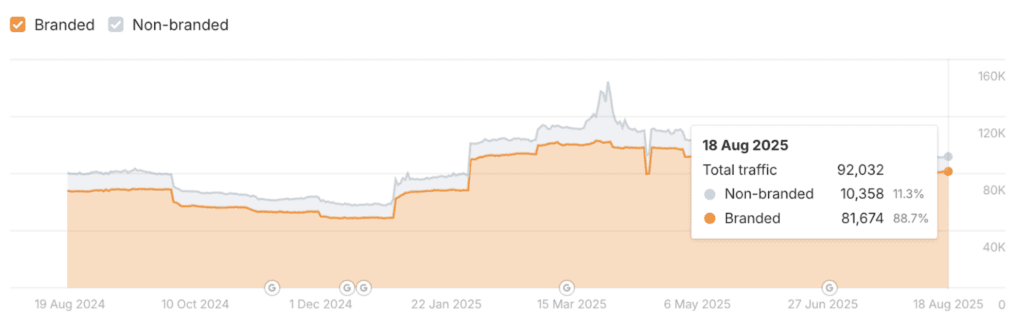

Keyword distribution (branded vs. non-branded)

- As it currently stands around 88.7% of traffic is branded and 11.3% is non-branded.

- A year ago, 84.5% of traffic was branded and 15.5% was non-branded.

- Total traffic is up +14% year on year, powered by brand searches which is up by +20%. Non-brand is down −17%, and the mix has shifted further toward branded.

Competitor Landscape

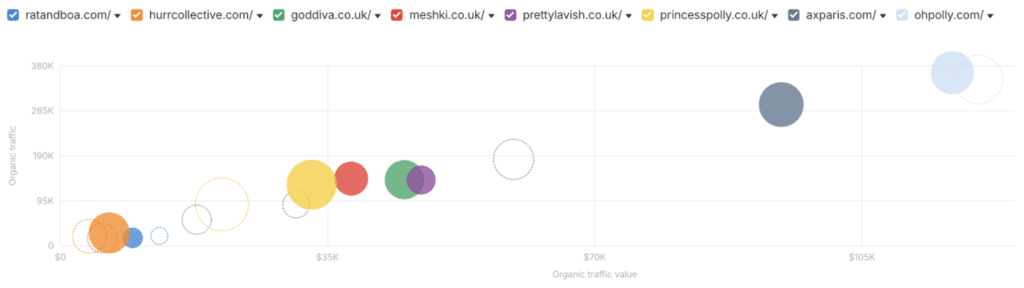

Leading competitors

- Oh Polly and AX Paris command the most search traffic and value. They’re the toughest to shift on broader & high volume keywords.

Mid-tier competitor

- Rat & Boa overlap on thousands of keywords with competitors, Meshki, Goddiva, Pretty Lavish and Princess Polly. These brands are actively adding lots of new pages which includes both product & new categories, which is fueling growth.

High-authority outlier

- HURR has much less traffic but strong site authority at 67 which is likely to crop up on occasional queries that overlap with Rat & Boa. If this competitor decided to expand their categories and scale the website with additional content, they could quickly overtake Rat & Boa.

What They’re Doing Well

- Overall traffic is up year on year, but is starting to slowly decrease over the last couple of months.

- Rankings in positions 1–3 and 4–10 are broadly steady, but haven’t seen growth.

- Authority is improving as their Domain Authority has climbed from 41 to 48 (+7) which is great progress.

- Competing within the same space as some established brands such as Meshki, Goddiva, Pretty Lavish, Princess Polly, indicating there is room to overtake them,

Where They’re Not Doing Well

- Too reliant on branded search: Rat & Boa is great at capturing people who already know the brand, but not great at growing enough with shoppers who search for categories, products or inspiration intent terms..

- Limited new customer growth: Brand searches are mostly existing fans; non-brand is where discovery happens.

- Fragile: If PR/social/paid brand activity slows, brand demand dips and traffic falls with it.

- Easy to attack: Competitors can bid on your brand name in ads and steal clicks.

- Ceiling on scale: You miss big, evergreen terms like wedding guest dresses, satin midi dress, holiday dresses, which can deliver steady demand year-round.

- Lost keyword breadth: Total ranking keywords fell 58.7k → 30.3k, mostly at the long tail (51+). We’re showing up for fewer niche searches.

- Page-2 opportunities: Around 3,280 keywords sit in positions 11–20, very close to getting on page 1 of Google but not yet delivering traffic or revenue for Rat & Boa.

- Rivals are out-publishing Rat & Bao: Mid-tier competitors are adding lots of pages (e.g., Meshki +878, Goddiva +2.1k), fuelling their growth through scaling their content production.

Quick Wins We’d Prioritise

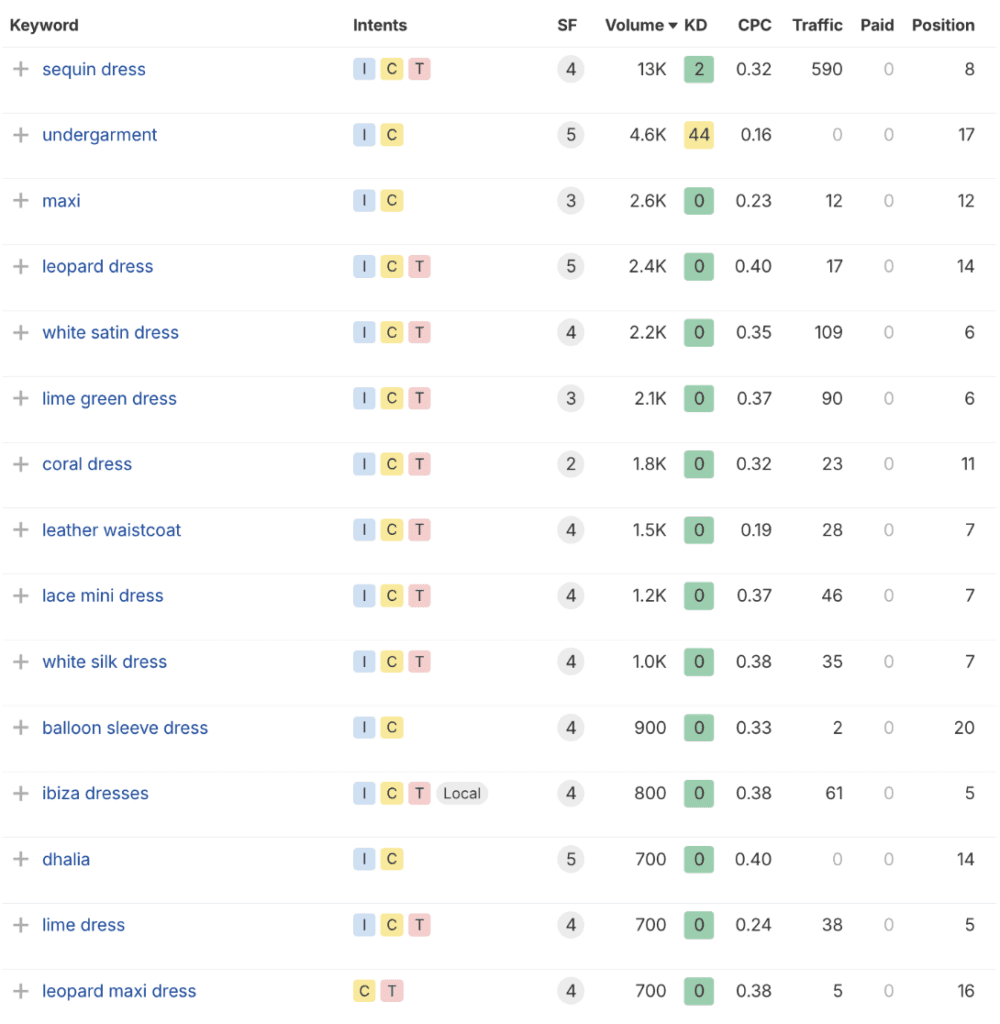

Low-hanging fruit

Based on your current keyword rankings, there is a strong opportunity to drive additional organic traffic and revenue by focusing on ‘quick wins’ through improving ranking positions of highly relevant, purchase-driven search terms.

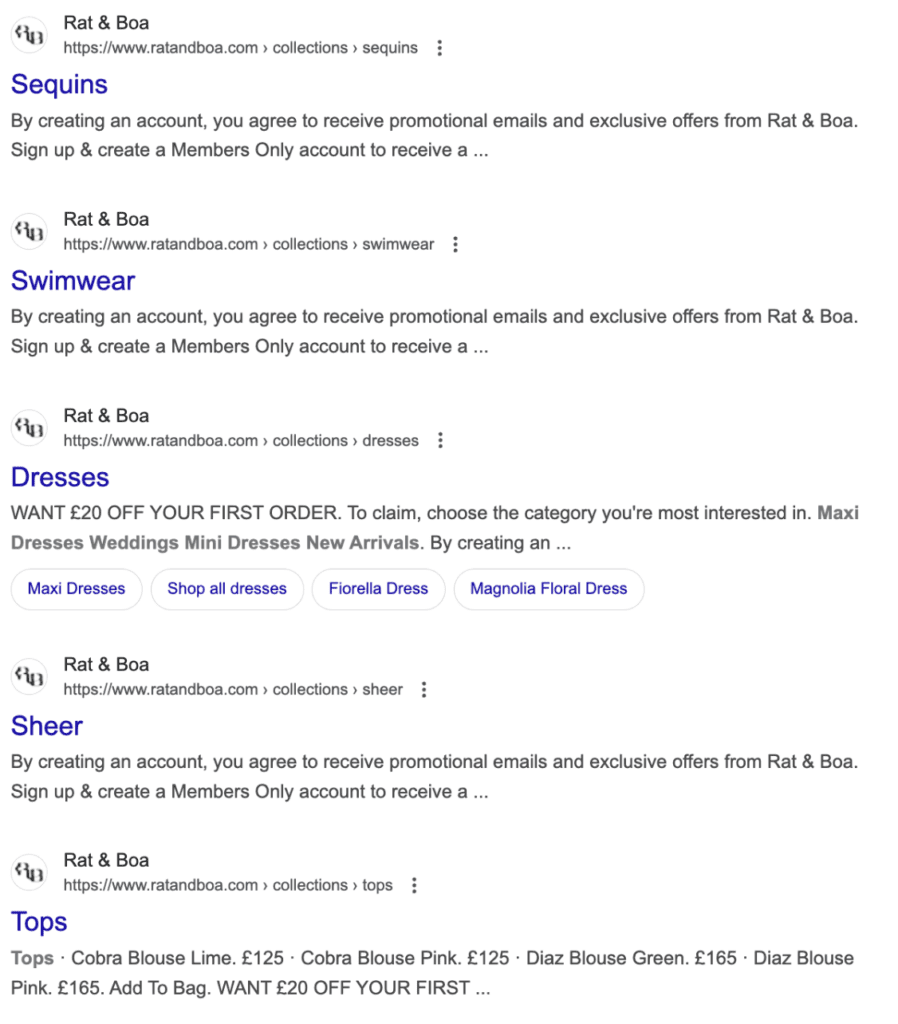

Metadata optimisation

Metadata optimisation

Page titles and meta descriptions are not optimised and are limiting Rat & Boa’s ranking potential and click through rate to get more users onto your site.

Internal linking

Category pages have navigation blocks set up which filter down the product listings, however, this is a lost opportunity where these could link to other pages directly on site to support SEO performance.

Also, category content doesn’t include internal links to other similar categories across the website, which is a missed opportunity to improve SEO, an example is Pretty Lavish who does this consistently within their category content.

Page speed

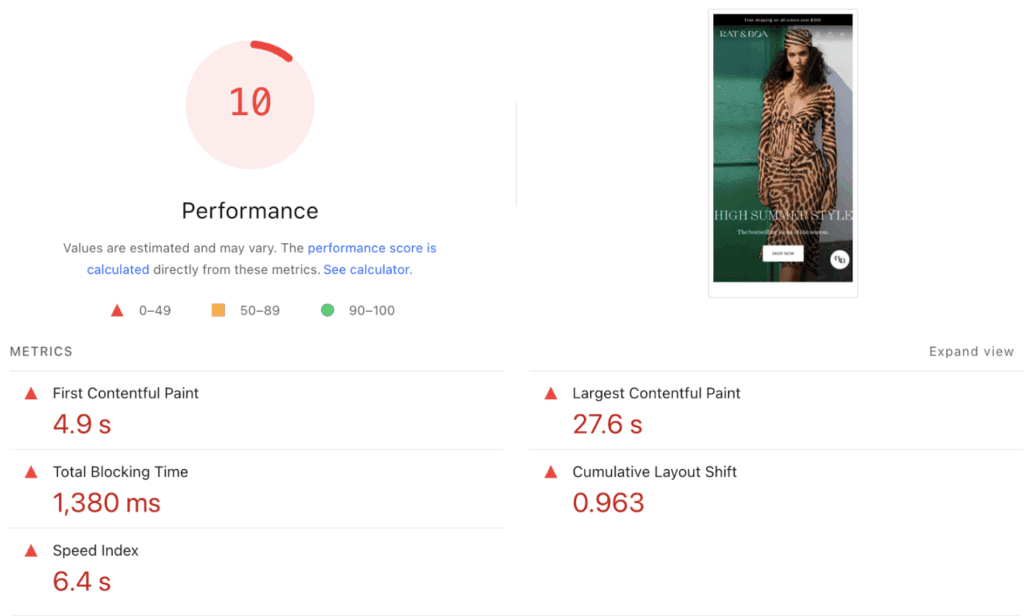

The website scored a 10/100 for its mobile score which is very low.

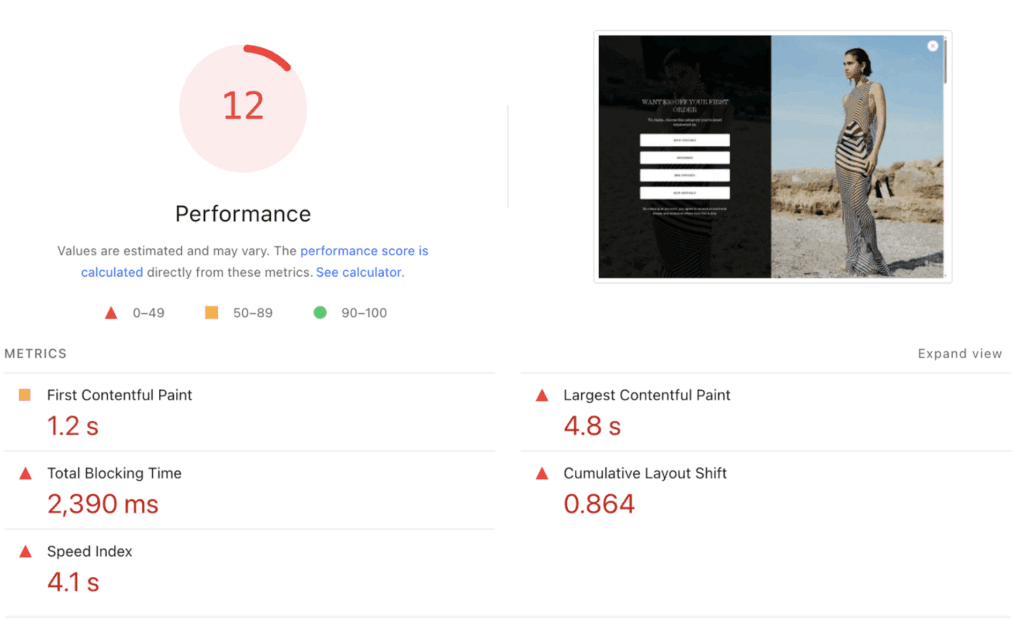

The website scored a 12/100 for its desktop score which is very low.

The website failed its Core Web Vitals test.

Core web vitals is a ranking factor that Google takes into account when evaluating your website and can impact your rankings and limit your organic potential if not resolved.

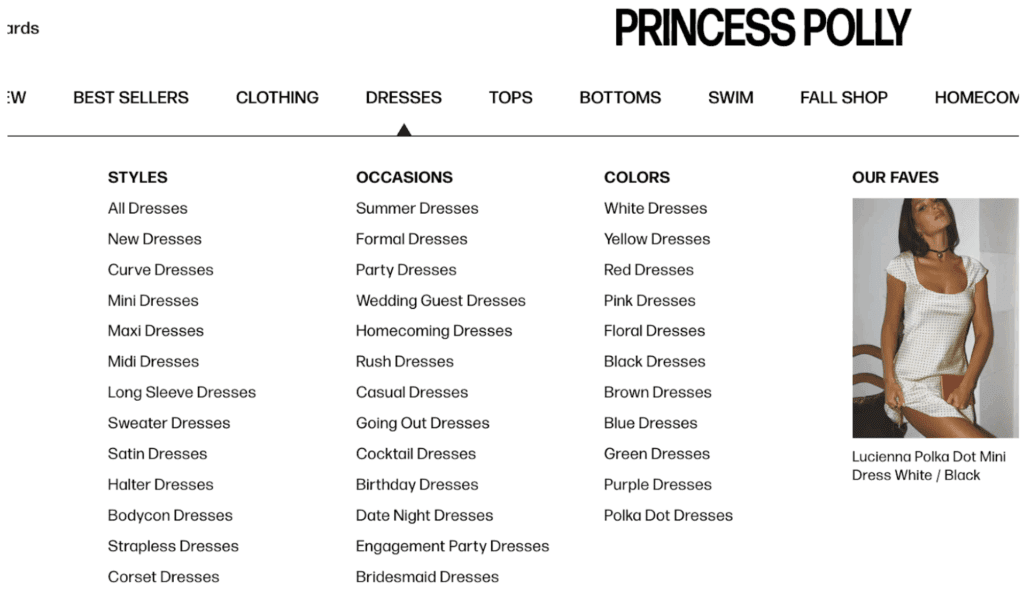

Expand & create new category pages

Build targeted category pages for styles, product types, and occasions to capture high-intent searches, boost discoverability, and guide shoppers to the most relevant products.

Princess Polly has created various new categories based on occasions, colour and styles just for one type of clothing yet this allows them to target and show up for thousands of different keywords, widening their audience and generating more revenue.

Pretty Lavish have created dedicated category pages for every style of bridesmaid dress available.

Ready to Grow?

We’ve helped brands like PRYA Jewellery and In-House grow organic revenue. If you’d like the same, then get in touch with us today and let’s discuss how SEO can grow your business.